Challenges of Real-World Asset Tokenisation and How to Overcome Them

RWA tokenisation unlocks liquidity and global access, but faces challenges like regulation, valuation, security, and adoption. Discover practical strategies to overcome them and build trusted tokenisation platforms.

Imagine turning a piece of real estate, a rare painting, or even a collectable into digital tokens that anyone can invest in instantly and securely. This is the promise of real-world asset (RWA) tokenisation: breaking down high-value assets into digital shares, making investment accessible to more people, and improving liquidity.

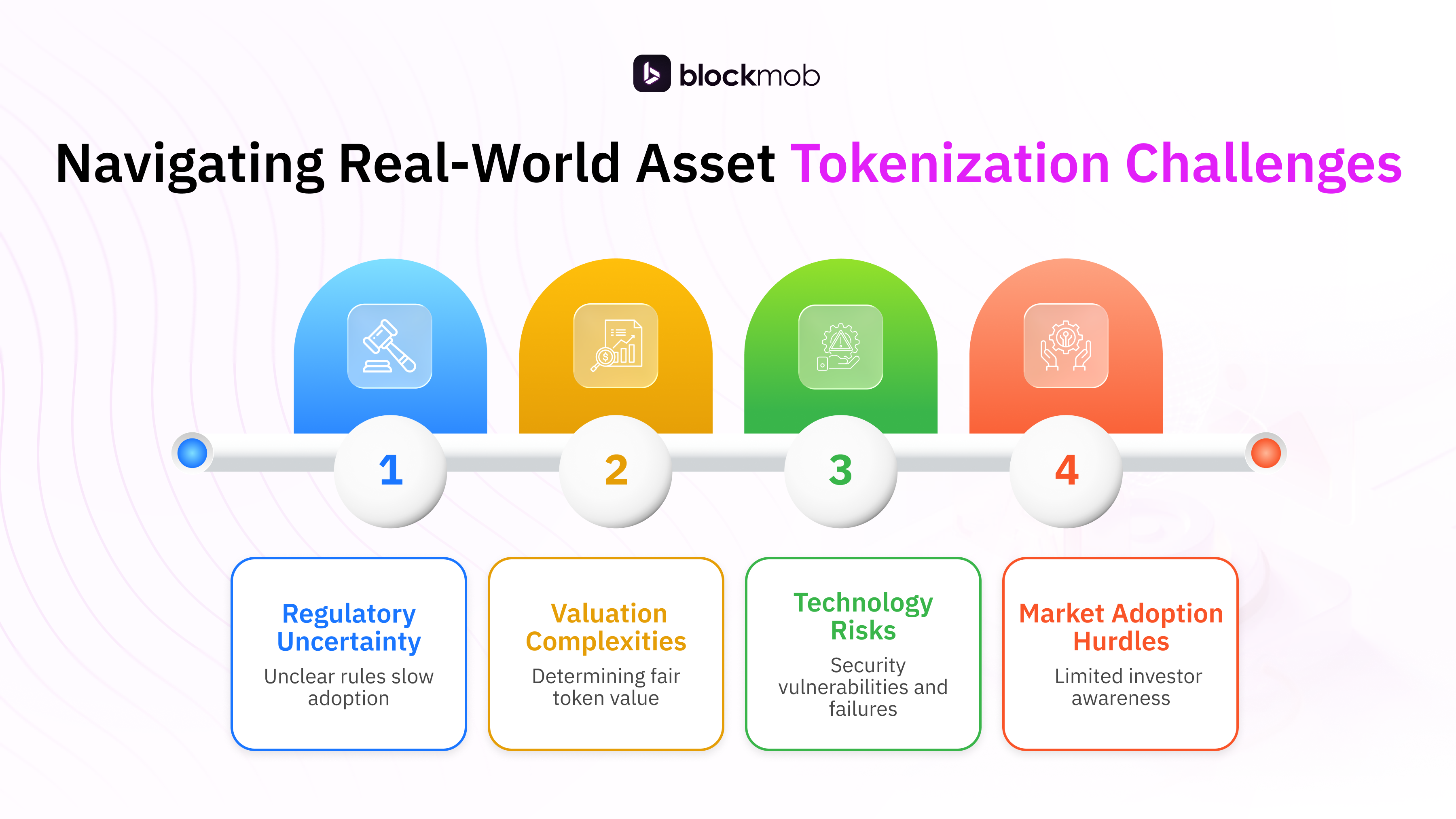

It sounds like a revolutionary step for investors and asset owners alike. However, like any emerging technology, RWA tokenisation comes with its own set of challenges. Regulatory uncertainty, valuation complexities, technology risks, and market adoption hurdles can slow down progress.

In this blog, we’ll explore the key challenges of tokenising real-world assets and practical strategies to overcome them, helping businesses and investors make the most of this exciting opportunity.

Understanding Real-World Asset Tokenisation

Before diving into the challenges, let’s briefly understand what tokenisation means. Real-world asset tokenisation is the process of converting physical assets into digital tokens that represent ownership or value. These tokens live on a blockchain, providing a secure, transparent, and immutable record of ownership.

Examples of tokenised assets include:

- Real estate properties

- Gold or other precious metals

- Artwork and collectables

- Intellectual property rights

The benefits of tokenisation are clear: fractional ownership allows more people to invest in high-value assets, liquidity improves as tokens can be traded on secondary markets, and blockchain ensures transparency and security. Think of it as buying shares in a property, a piece of art, or even a luxury item, without having to own the entire asset physically.

Key Challenges of RWA Tokenisation

While the concept is exciting, several challenges need careful consideration:

1. Regulatory and Legal Issues

Different countries have different laws regarding securities, digital assets, and property ownership. Some jurisdictions may not recognise tokenised assets as legally binding. Without clear regulatory frameworks, investors and businesses face uncertainty, which can slow adoption.

2. Valuation and Price Discovery

Determining the fair value of a tokenised asset can be complex. Real estate, fine art, and collectables often fluctuate in value, and an accurate appraisal is critical. Inconsistent valuation methods can undermine investor confidence.

3. Liquidity Concerns

Tokenisation is designed to improve liquidity, but it doesn’t automatically guarantee it. Tokens may struggle to find buyers in secondary markets, especially for niche or high-value assets.

4. Technology and Security Risks

Smart contracts, blockchain platforms, and wallets are not immune to bugs or security vulnerabilities. A single coding error or cyber attack can compromise assets or investor trust.

5. Trust and Adoption

Tokenisation is still a new concept for many investors and asset owners. Lack of understanding, fear of fraud, or scepticism about digital assets can slow adoption and market growth.

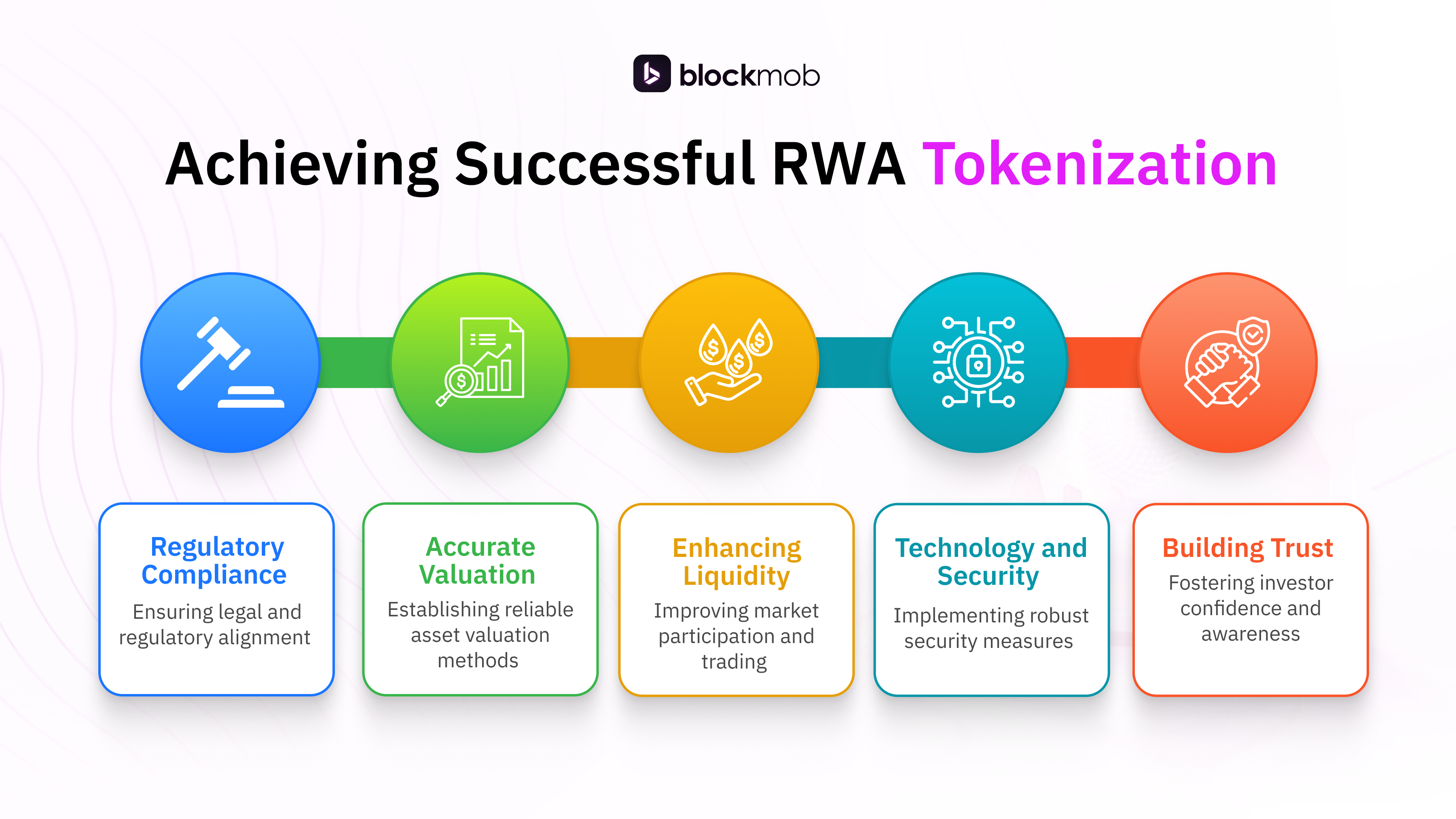

How to Overcome These Challenges

Despite these challenges, there are practical strategies to make RWA tokenisation successful:

1. Regulatory Compliance

- Engage legal experts familiar with digital asset regulations.

- Ensure platforms comply with local and international securities laws.

- Consider jurisdictions with clear and supportive regulatory frameworks for tokenisation.

2. Accurate Asset Valuation

- Partner with trusted appraisers for real-world assets.

- Use AI and analytics tools to assess market value objectively.

- Provide transparent valuation reports to investors for confidence.

3. Enhancing Liquidity

- Collaborate with established exchanges and secondary marketplaces.

- Encourage fractional ownership to attract a wider investor base.

- Promote secondary trading and liquidity pools for tokenised assets.

4. Technology and Security Best Practices

- Conduct thorough audits of smart contracts and blockchain infrastructure.

- Choose secure, proven blockchain platforms.

- Educate clients and investors on wallet security and digital asset best practices.

5. Building Trust and Awareness

- Offer clear documentation, educational resources, and tutorials.

- Highlight successful case studies to showcase the potential of tokenisation.

- Provide reliable advisory support to guide investors through the process.

Real-World Impact

Despite the challenges, tokenisation is already transforming industries:

- Real estate platforms are offering fractional ownership of high-value properties, making investment accessible to small investors worldwide.

- Art and collectables are being tokenised to allow multiple investors to share ownership while preserving provenance and authenticity.

- Companies are leveraging tokenisation for intellectual property rights, royalties, and revenue-sharing models.

Businesses that adopt blockchain-based tokenisation platforms early gain a competitive advantage through efficiency, transparency, and access to a global investor base.

Conclusion

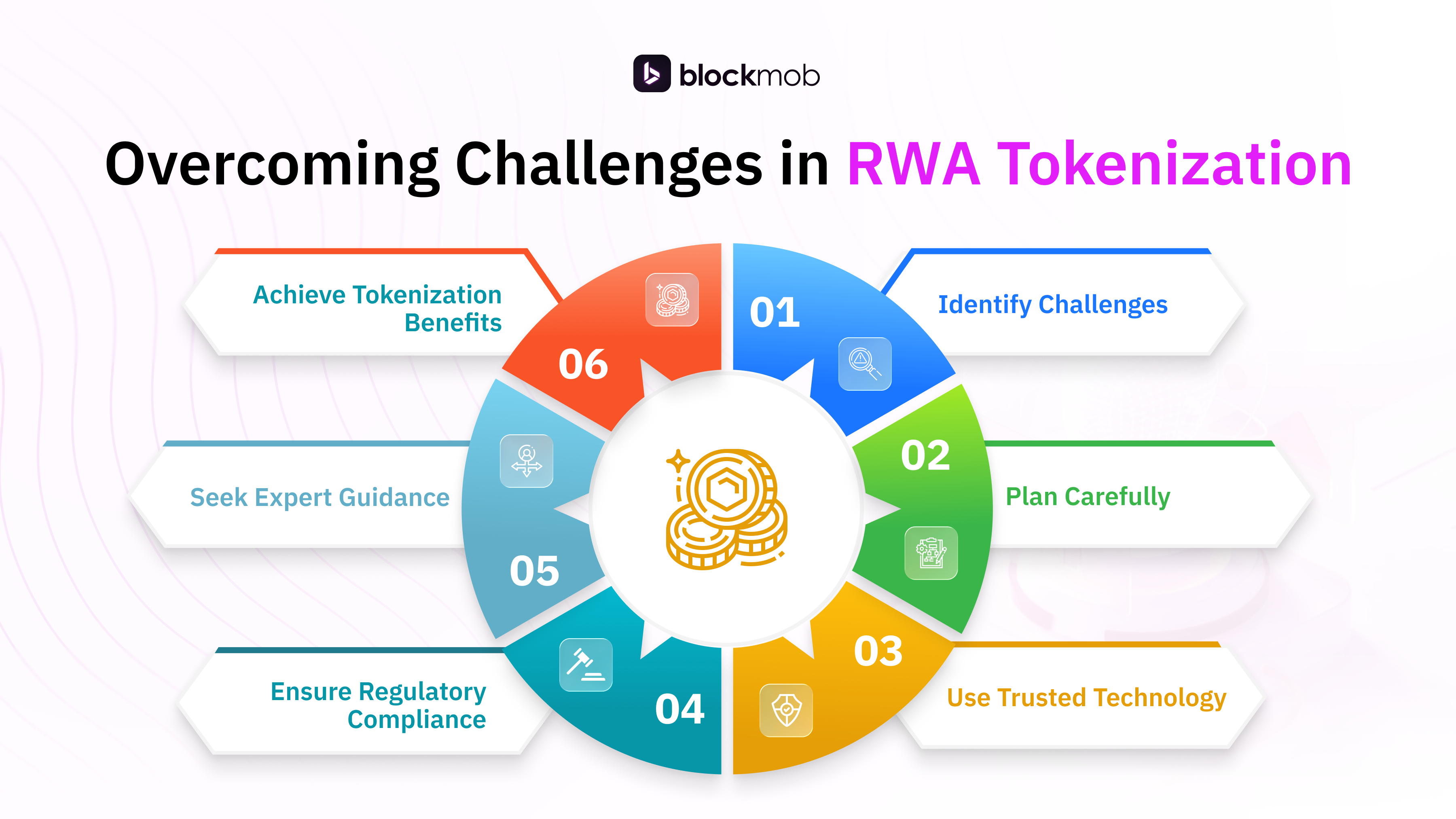

Real-world asset tokenisation is revolutionary, but it comes with challenges. Legal complexities, valuation issues, liquidity concerns, technology risks, and adoption hurdles cannot be ignored.

However, with careful planning, trusted technology, regulatory compliance, and expert guidance, these challenges can be overcome. Tokenisation offers a future where high-value assets are more accessible, liquid, and secure than ever before.

Navigating the challenges of real-world asset tokenisation requires expertise and reliable technology. At BlockMob Labs, we provide end-to-end solutions for tokenising assets, from legal compliance and valuation to secure blockchain implementation. Our team helps businesses and investors unlock liquidity, transparency, and global reach for their assets efficiently and safely.